Happy Sunday fellow Bitcoiners,

This is our first weekend edition of Bitcoin Wisdom (figured you'd prefer reading this on a Sunday morning alongside your daily coffee☕).

Ten days ago, the government shutdown ended. Twitter flooded with calls for "liquidity injection to boost Bitcoin back to $150K+!"

Bitcoin was $104K then. This morning? ~$84K.

The same analysts who blamed the shutdown now attribute Bitcoin’s move to something else entirely. Macro guys say it was the Fed, technical analysts draw new lines, and conspiracy theorists cry "BlackRock manipulation".

The truth of the matter? Bitcoin is down because there are more sellers than buyers. That's it. Everything else is sophisticated-sounding rubbish.

This week we're discussing👇

Why we force every problem into our favorite framework;

How this obsession with a narrative destroys us (as Bitcoin investors); and

Three Practical ways to escape the trap and grow your stack.

Let's get to it⚡

"If all you have is a hammer, everything looks like a nail”

1️⃣ The Trap of Maslow’s Hammer

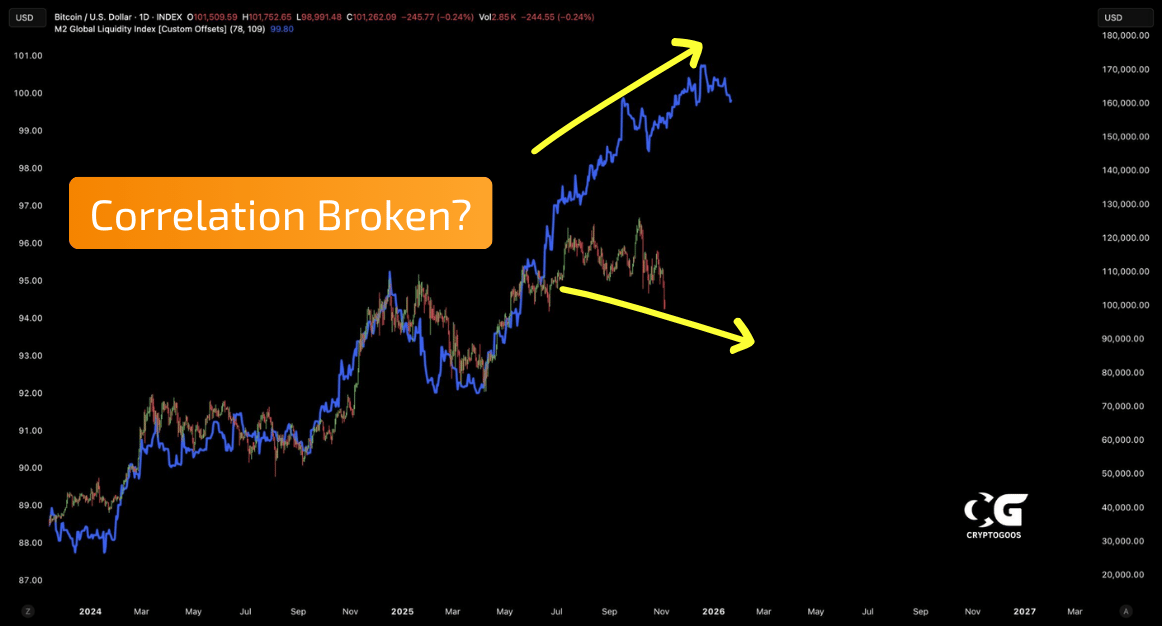

I’ve been tracking Bitcoin against global M2 liquidity for years (ever since @RaoulPal from Real Vision shared his now infamous chart).

It's been one of primary frameworks. Bitcoin tracks liquidity. When M2 goes up, Bitcoin follows. The chart doesn't lie (and the correlation has historically been very strong).

Last month, M2 was trending up. The historical correlation was clear. I thought "Surely this gap (see below) will close and we're staying in a bull market. No way we break lower with liquidity expanding".

So I pulled the trigger. Made a big Bitcoin purchase at $102K.

Bitcoin's now ~$84K and what should have been a strategic weekly DCA is now looking like a bad entry point.

Turns out "Bitcoin tracks M2" is just another hammer. And I used it to convince myself to buy at one of the worst possible times.

My framework failed me: I was so focused on my liquidity hammer that I ignored everything else. Price action. Sentiment. On-chain data, or just the fact that we’d been in a bull market for the last ~2 years.

None of it mattered because “M2 is going up”.

This is Maslow's Hammer, one of Munger's favorite mental models for explaining how smart people make dumb decisions.

2️⃣ How Bitcoin Investors Hammer Everything

The Bitcoin community is infested with narrative hammers. We’ve got:

The Macro Hammer:

"It's all the Fed!" Market pumps? Must be a Dovish Fed meeting. Market dumps? Hawkish Fed signaling. But wait, didn’t Bitcoin pump during rate hikes? Yes it did…

The Technical Hammer:

"The charts tell us everything!" Respects lines? TA works! When Bitcoin eventually blows through their resistance? Don’t worry, just a fakeout.

The Conspiracy Hammer:

"It's market manipulation!" Bitcoin goes up? Trap the shorts. Down? Trap the longs.

What actually happened? Simple - Bitcoin went $25K to $125K in two years. People who bought @ $120K are underwater. Many OGs sold and net new buyers aren't absorbing enough of it.

Price went down. More sellers than buyers.

But nobody wants that because it's boring. So everyone retrofits their narrative AFTER price moves.

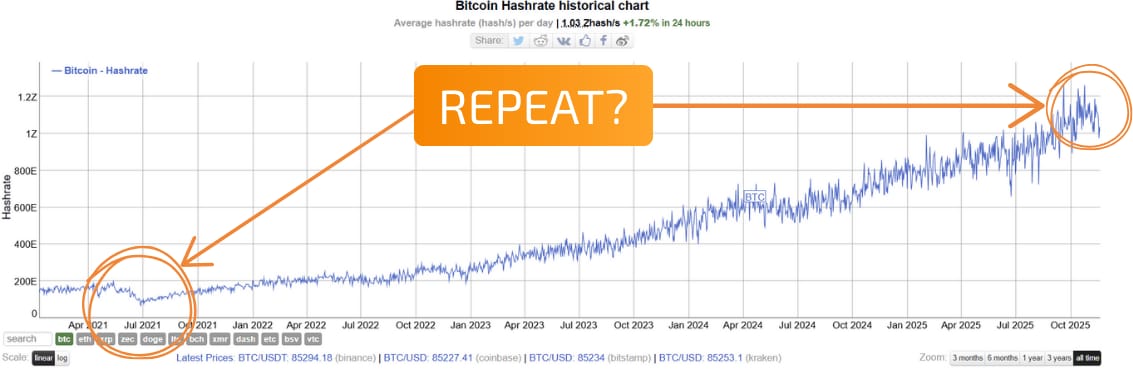

Here's a data point nobody's discussing: Bitcoin hashrate just hit its first sustained decline since March 2021 - right when Bitcoin last topped. Hashprice dropped to $38/PH/s, a five-year low.

The macro guys blame Fed policy. On-chain guys say it's bullish ("miners capitulating = bottom"). Technicals guys say hashrate doesn't matter (because “its all in the price”).

They're all using their own hammers. None are asking: what if it's just supply and demand in both markets?.

As we covered in Orange Box Thinking, narrative follows price. The price moves first. Then humans construct stories because we hate uncertainty.

3️⃣ Escaping the Hammer Trap

Strategy #1: Ask "What Else Could Explain This?"

Before any purchase, force yourself to answer: "What else could explain this setup?"

M2 says buy? What else matters? Price action, sentiment, positioning.

Charts look perfect? What else matters? Fundamentals, macro, capital flows.

Everyone's bullish? What else could happen? Liquidations, macro shocks, unexpected whales selling.

Force yourself to name three alternative explanations before pulling the trigger. Can't do it? Don't buy yet.

Strategy #2: Dollar-Cost Average Your Convictions

Think Bitcoin's going to hold the line at $100k and bounce up to $150K because of M2? Great. Don't deploy all your fiat at $102K like I did.

Split your intended position into four weekly purchases:

Week 1: Buy 25%

Week 2: Buy 25%

Week 3: Buy 25%

Week 4: Buy 25%

Your hammer might be right, just early. DCA protects you from timing failures while still letting you act on conviction.

Strategy #3: Set "Hammer Breaker" Alerts

Identify what would BREAK your favorite framework, then set price alerts for it:

M2 reverses down? Set alert at -2% from current level.

Bitcoin breaks support despite M2 up? Alert at key technical level.

Hashrate recovers despite bear market? Track it weekly.

If your hammer breaks, reassess immediately. Don't ignore the warning signs!

Key Takeaway

The problem isn't Bitcoin's price action. It's your obsession with explaining it.

Maslow's Hammer describes our tendency to over-rely on one mental model. Macro guys blame the Fed, analysts draw lines in retrospect, conspiracy theorists see manipulation.

The reality is simpler: supply and demand. More buyers means up. More sellers means down. Everything else is narrative we create to feel smart.

Stop searching for explanations. Start using price productively.

The investors who win act with discipline regardless of the narrative. When everyone's hammering their favorite explanation, the disciplined investor is quietly accumulating.

Your stack doesn't care why Bitcoin moved. It only cares whether you bought the dip or spent your time retrofitting a narrative to try and explain it to yourself.

Maybe that's not the sophisticated answer you wanted. But it's the honest one.

Stay grounded,

@Publius256

P.S. If you enjoyed this article, please consider sharing it on X (we'll retweet one subscriber’s response every week).