Christmas week. I ate what felt like my body weight in chocolate.

The result? Brain fog. Sluggish. Regret.

Then I started cleaning up my portfolio for year-end. Shutting down my old MetaMask wallet. And there it was: some random shitcoin called EigenLayer that had been airdropped into my account. Down 60% from launch.

When I took a moment I realized. They’re the exact same feelings, just different scenarios.

Logically, it makes sense - if you are what you eat, then surely you also are what you own in your financial portfolio.

This Sunday in Bitcoin Wisdom, we dive into why your portfolio diet matters more than your food diet, and why 2025 is the year you stop feeding yourself garbage.

1. The Psychology of Consumption

"You are what you repeatedly do. Excellence, then, is not an act, but a habit"

Your body becomes what you feed it. Junk food in, sluggish performance out. This isn't controversial, it’s a biological fact.

What people don't recognize in their daily lives, is that the exact same principle applies to your financial portfolio.

Psychologists call this identity-based behavior. You don't just eat healthy food. You become a healthy person. You don't just buy Bitcoin. You become a Bitcoiner.

The inverse is also true.

Why Junk Consumption Compounds

When you eat garbage, you feel like garbage. When you feel like garbage, you make garbage decisions.

Portfolio version: When you buy shitcoins, you start thinking like a shitcoiner. You chase pumps. You believe VC promises. You trade on emotion instead of conviction.

Last week in "The Waiting Game" we covered delayed gratification. Eating clean requires the same discipline as hodling Bitcoin. Instant gratification (chocolate, altcoin pumps) feels good for 30 seconds. Long-term discipline builds actual results.

The Information Diet Problem

You're not just consuming food and investments. What you’re really consuming is information.

Those macro gurus on Twitter who "predicted" every crash for the last 5 years? Information junk food.

VCs telling you to buy their bags? Information poison.

One of the best examples? Berachain Foundation announcing a "coordinated halt" like it's a feature (we’ll get to that later).

The more you consume this poisonous information, the more it shapes your thinking. Your thinking shapes your actions, and ultimately your actions determine your portfolio and financial performance.

Partner Recommendation

Eat clean this year and secure your Bitcoin stack.

You've cleaned up your portfolio. Now make sure you protect it properly.

Blockstream Jade Plus is a Bitcoin-only hardware wallet with no shitcoin support. It’s open-source, air-gapped for security and is 100% noob-friendly.

Use code BITCOINNEWS for an even bigger Christmas discount 👇

2. Altcoins are Junk Food

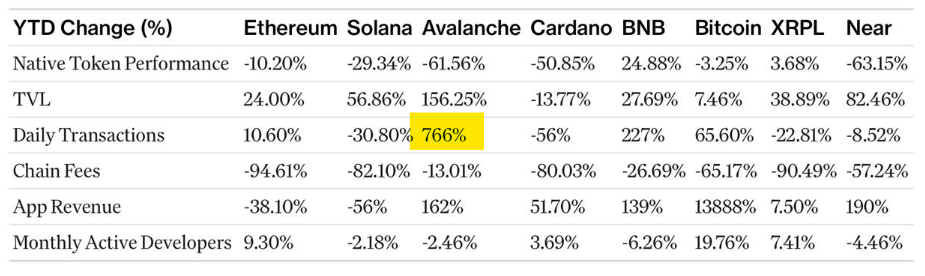

Let's look at the data (because blockchain data doesn't lie).

The 2025 Scoreboard

Native Token Performance (YTD):

Ethereum: -12.2%

Solana: -29.3%

Avalanche: -61.5%

Cardano: -50.9%

Bitcoin: -6.5%

The most hilarious thing about the above performance is that many people actually try to justify these losses by pointing to "on-chain fundamentals" as if that tells the story and should convince you to continue holding the bag.

"Solana has high throughput!" (Down 29%)

"Ethereum has the most robust developer ecosystem!" (Down 12%)

"Cardano is peer-reviewed!" (Down 51%)

Meanwhile, chain fees are down 65-94% across all these networks. But yeah, fundamentals matter… right?

The MetaMask Cleanup

I'm shutting down my MetaMask wallet for year-end. Consolidating everything. Getting clean.

There it is: EigenLayer. Some airdrop I never asked for. Down 60% since launch.

This is the VC playbook. Create a token. Airdrop it to wallets. Generate fake "distribution" and “active wallets” statistics to impress your VC’s and then execute the dump.

I never bought this. It just appeared. Like finding a candy wrapper in my pocket after promising myself I'd eat clean.

The Berachain Disaster

On November 3rd, the Berachain Foundation posted this:

"The Berachain validators have coordinated to purposefully halt the Berachain network as the core team performs an emergency hard fork to address Balancer V2 related exploits on the BEX"

"Coordinated to purposefully halt the network" - what a joke (it’s supposed to be decentralized right? Because if it wasn’t, then why the hell is it on a blockchain database in the first place?).

You can't coordinate to halt Bitcoin. You can't emergency hard fork away problems. The network doesn't care about your exploit. Rules are rules.

But Berachain? The validators just decided to stop. Centralized control pretending to be decentralized infrastructure.

Why "Fundamentals" Don't Matter

Avalanche had 766% growth in daily transactions. Still down 61%.

The market doesn't care about your fundamentals. It cares about liquidity, narrative, and whether you're the sucker providing VC’s with their exit liquidity.

Bitcoin doesn't have fundamentals. Bitcoin IS the fundamental.

What's your portfolio diet for 2025?

Additional feedback: What's the worst altcoin you're still holding? Reply and confess. Most honest answer gets 2,100 sats.

3. Your 2025 Portfolio Diet

End of year. Time to clean house. Not just your pantry or chocolate drawer. Your actual portfolio.

Your Three-Question Audit

Q1: What am I actually consuming?

Go through your exchange accounts. All of them. That old Binance account. The Coinbase you haven't touched since 2021. The MetaMask wallet with random airdrops.

Write down every position. Be honest.

If you're holding tokens that launched with VC backing, you're eating junk food.

Q2: Why am I holding this?

For each non-Bitcoin position, answer honestly:

Did I buy this because of conviction or FOMO?

Can the network halt if someone finds a bug?

Do VCs control the majority of supply?

If you can't justify holding it based on first principles, you're feeding yourself garbage.

Q3: What do I want to become?

Do you want to be a trader? Chase pumps? Live on VC timelines?

Or do you want to be a Bitcoiner? A long-term thinker who’s broadly immune to the noise?

Remember Aristotle? You are what you repeatedly do.

If you repeatedly buy altcoins, you become an altcoiner. If you repeatedly stack Bitcoin, you become a Bitcoiner.

Key Takeaways

We're all eating junk. Chocolate during Christmas. Shitcoins in our portfolios.

The data doesn't lie. Ethereum down 12%. Solana down 29%. Avalanche down 61%. Berachain executing a hard fork like it's just another minor inconvenience after a vulnerability was found (shocker, I know).

Three truths:

Your portfolio is your diet. Junk in, junk out. Bitcoin-only is clean eating for your wealth.

Identity determines action. Shitcoiners chase pumps. Bitcoiners stack sats. You become what you repeatedly do.

2025 is the year you clean house. Sell the garbage. Take the loss. Stop feeding yourself poison.

This New Year, skip the food diet. Focus on the portfolio diet.

Remember, if you are what you eat, eat Bitcoin.

- @Publius

P.S. Enjoyed this article? Share it on X and earn 2,100 sats 😉 (Tag @BitcoinNewsCom and we’ll send to your lightning wallet).